Top 5 Mistakes Parents Make When Planning For College

College has become the fastest-growing household expense in recent years, with tuition increasing 5.6% annually. Many schools are now part of the “Race to 100,” where yearly tuition could reach $100,000! College planning is one of the most significant financial decisions families make—but it’s also one of the most misunderstood. Avoiding these common mistakes can make the process smoother and more affordable.

Mistake #1: Not Taking Full Advantage of Compound Investing

Cost of attendance is rapidly rising, so it’s essential for families to budget and invest to minimize reliance on student loans or depleting retirement accounts. The younger a child is, the more college will likely cost (due to more years of tuition inflation). For a child born today, it is estimated that 4-year tuition at colleges will range from $250,000 to $600,000. The only way to outpace inflation is to take advantage of your long-time horizon and the power of compounding.

Don’t wait, start saving and investing early! For example, if you started investing for a newborn today and invested $500/month into a 529 plan for 18 years at a 7 % return, you would have $210,000. But if you waited 10 years and invested the same amount, you would have $63,000 by the time they are 18.

Mistake #2: Utilizing The Wrong Investment Vehicles

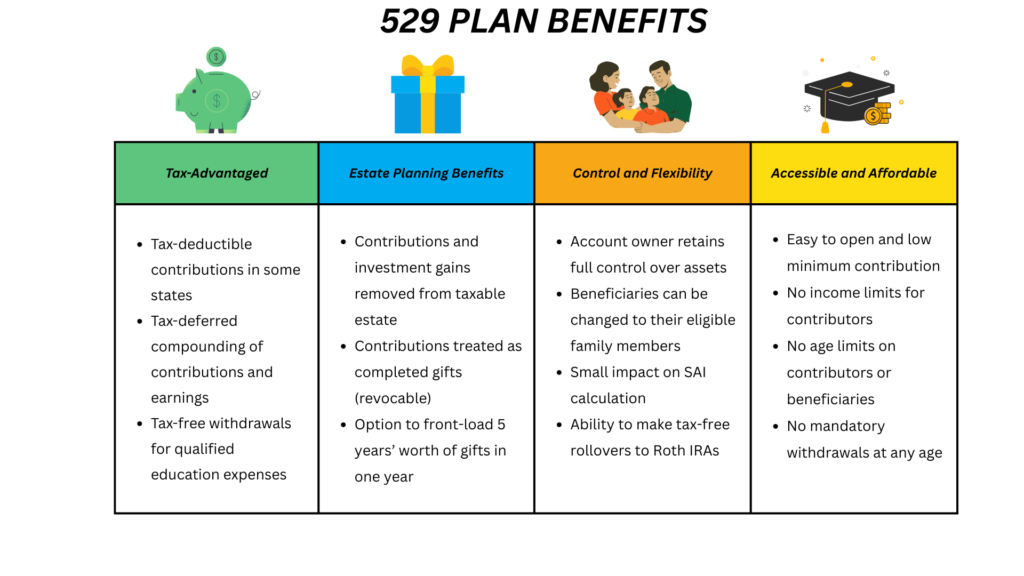

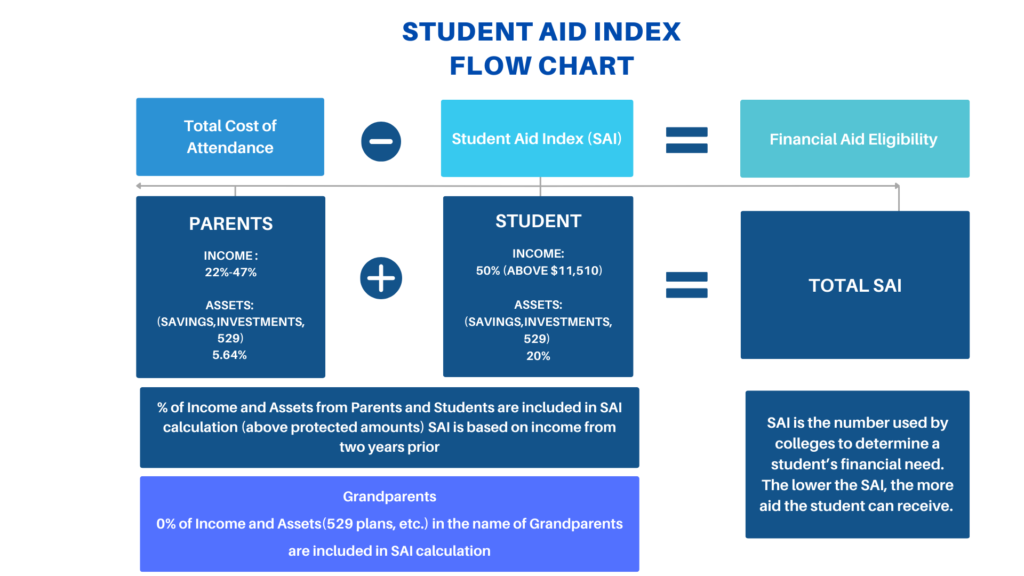

Don’t keep college funds in a checking account or as cash in a brokerage account. Use beneficial investment vehicles tailored for qualified education expenses. There are several tax-advantaged savings vehicles available to families. The 529 College Savings Plans are the most popular because they offer tax-free growth and tax-free withdrawal when used for qualified education expenses. Be mindful of specific state laws for your 529 plan and how the account is structured. Placing too many assets in the student’s name can reduce their eligibility for financial aid, as student assets (20%) are assessed more heavily than parent assets (5.64%) in the FAFSA SAI (Student Aid Index) formula. Talk to your financial advisor to see how you can maximize your college savings/investment capabilities.

Student Aid Index is the value utilized by colleges to determine a student’s financial need. The lower the SAI, the more aid the student can receive.

Pro Tip 1: Under new FAFSA 2025 rules, you can move ownership of your 529 plan to grandparents and 0% of the account value will be used to calculate SAI. Before you decide to make this transfer of ownership, calculate the cost of attendance and student aid index. Make sure that the math makes sense.

Do you want more information on the best college savings accounts? Check out our blog, “Best Savings Vehicles to Minimize College Debt.”

Mistake #3: College Planning Procrastination

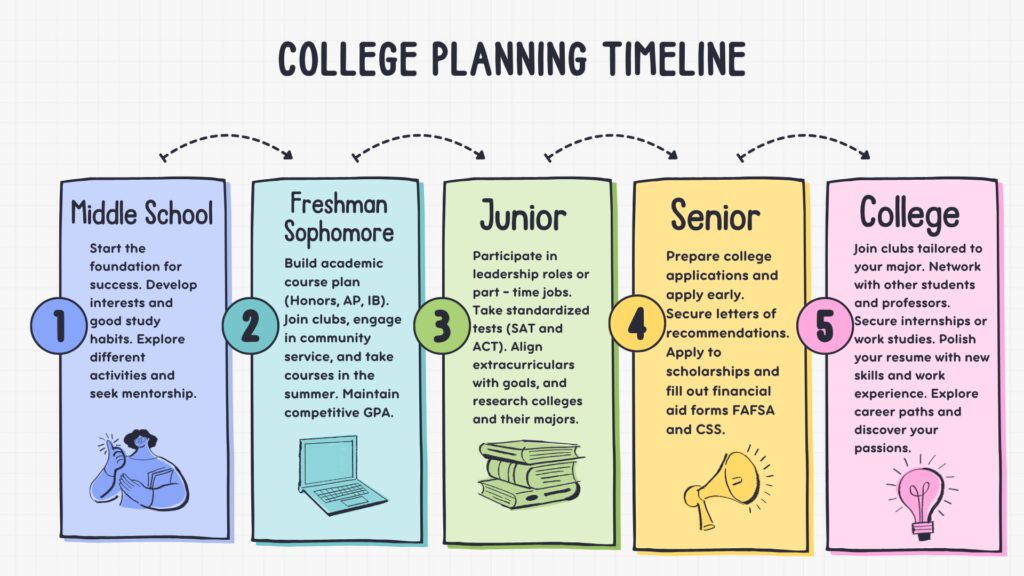

Start having college conversations with your student early on and set goals. Big-picture decisions — like choosing between a four-year university or starting at a two-year community college and transferring — can dramatically shape the steps your student needs to take in high school. From course selection to extracurricular involvement, these choices influence the entire college strategy.

Ideally, conversations about higher education should begin as early as middle school and continue regularly as your student progresses toward college. This is where the foundation of good study habits is built and it is a great time to start exploring passions in extracurricular and leadership activities.

Pro Tip 2: Khan Academy

Use Khan Academy’s free college planning guide. These 7 modules give a great step-by-step college planning tutorial. Topics covered include Making High School Count, Applying to Colleges, Paying for College, and Life After College.

Pro Tip 3: BigFuture

Use Big Future by College Board. This is The College Board’s free and comprehensive college planning website. This tool provides scholarship opportunities and the ability to build a college list based on factors that matter to you.

Mistake #4: Assuming You Won’t Qualify for Financial Aid/ Not Filling out FAFSA

Fill out the financial aid forms, don’t assume that you won’t get aid based on income alone. This assumption could potentially cost students thousands of dollars in missed opportunities. The Free Application for Federal Student Aid (FAFSA) is required every year a student is enrolled in college, to receive any type of financial assistance. This includes scholarships, grants, work-study programs, and low-interest federal student loans. Even if you don’t believe you qualify for federal aid, there is nothing to lose.

Having the FAFSA on file keeps your options open in the event of unforeseen financial challenges, such as a parent losing a job or passing away. These life-altering events can impact aid eligibility, and having the necessary forms already submitted makes it easier to receive the support you may suddenly need.

Pro Tip 4: Appeal for more financial aid, call the financial aid office for professional judgment, and write an official letter to the FAFSA office. If you believe you are entitled to more aid due to unforeseen circumstances (e.g., work layoffs, major medical expenses, divorce ), don’t hesitate to ask.

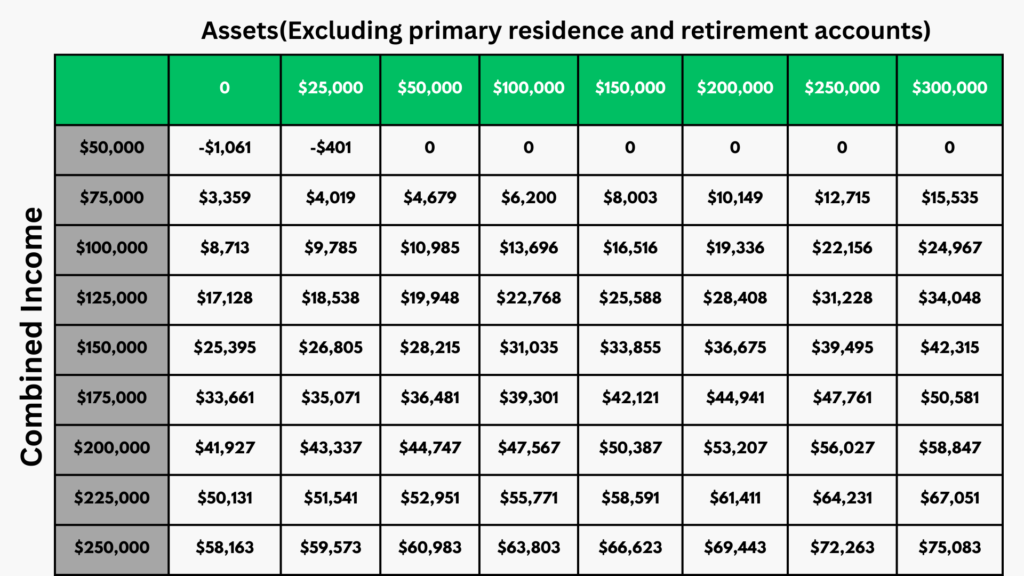

This chart helps you estimate your SAI based on your family’s income and assets. (e.g., Your family has a combined income of $100,000 and $0 in assets, your SAI is $8,713 vs income of $150,000 and $0 in assets, SAI is $25,395 ) Income’s impact on SAI is much greater than assets. Remember, lower SAI = more aid eligibility.

Pro Tip 5: DOE SAI Calculator

Use The U.S. Department of Education’s Federal Student Aid Calculator to Estimate your SAI.

Mistake #5: Focusing Only On The “Top” Schools

Parents should avoid limiting their student’s college applications to only “top” schools. While these institutions may have name recognition, they aren’t always the best fit academically or financially.

In-state public universities and community college transfer programs often provide a high-quality education at a fraction of the cost. Additionally, many out-of-state public schools offer generous merit-based aid to attract strong students—potentially making them a financially smarter choice for many families.

Encourage a balanced list of 6 to 12 schools (public and private), including a mix of safety, target, and reach schools. Ideally, your student will have multiple offers to choose from. This creates an opportunity to conduct a cost-benefit analysis—comparing the potential return on investment per school.

Pro Tip 6: College Scorecard

Tools like the U.S. Department of Education’s College Scorecard can help evaluate whether a particular school is “worth it” by comparing potential debt against graduates’ median earnings 10 years after enrollment.

Parents play a key role in shaping expectations throughout the college planning journey. Instead of focusing solely on where their student gets in, the priority should be helping them define their goals and plan for the future. What opportunities and resources can this college provide for my child? Rather than, how do I shape my child into the ideal student for this institution?

Focusing on tailored major programs, internship opportunities, and clubs for your student will help greatly towards a directed career path. It’s important to recognize that college is not the finish line—it’s the starting point of a much longer journey.